Curious about today’s crypto updates? Get the latest on Bitcoin, blockchain, DeFi, NFTs, Web3, and crypto regulations in our daily news roundup.

Analysts at JPMorgan suggest potential downward movement for Coinbase (COIN) stock this year. Additionally, Arkham Intelligence, a blockchain research platform, has reportedly pinpointed on-chain developments in Bitcoin.

BTC $39,589 addresses of several U.S. spot BTC exchange-traded funds (ETF), and U.S. lawmakers are pressing Mark Zuckerberg’s Meta about whether it plans to use any of its five blockchain and crypto-related trademark filings.

Downgrade Hits Coinbase Stock

JPMorgan has downgraded Coinbase’s stock due to Bitcoin’s underwhelming performance after the approval of nine spot exchange-traded funds (ETFs). In a recent investor note, the bank’s analysts expressed caution, stating that Coinbase’s stock has limited upside potential, leading to a downgrade to a “neutral” rating.

Despite maintaining a year-end price target of $80 for COIN, the current trading value of around $124 implies a downside potential exceeding 35%. JPMorgan acknowledged Coinbase’s position as the predominant U.S. exchange in the crypto ecosystem and a global leader in cryptocurrency trading and investing. However, the analysts believe that the expected catalyst from Bitcoin ETFs, which was anticipated to bring the ecosystem out of a downturn, has fallen short of market expectations.

The disappointment surrounding the Bitcoin ETF developments appears to be a key factor influencing the downgrade. While recognizing Coinbase’s significant role in the U.S. crypto landscape, JPMorgan’s analysts expressed reservations about the anticipated positive impact from Bitcoin ETFs, prompting the bank to take a more cautious stance on the exchange’s stock performance.

Bitcoin has experienced a drop below $40,000, driven by renewed selling pressure linked to Grayscale’s Bitcoin Trust (GBTC). Despite the outflows from GBTC, Bitcoin’s exchange-traded funds (ETFs) have witnessed over $1.1 billion in net inflows, as reported by Bloomberg analyst James Seyffart.

Arkham Discovers On-Chain Addresses for Spot Bitcoin ETFs

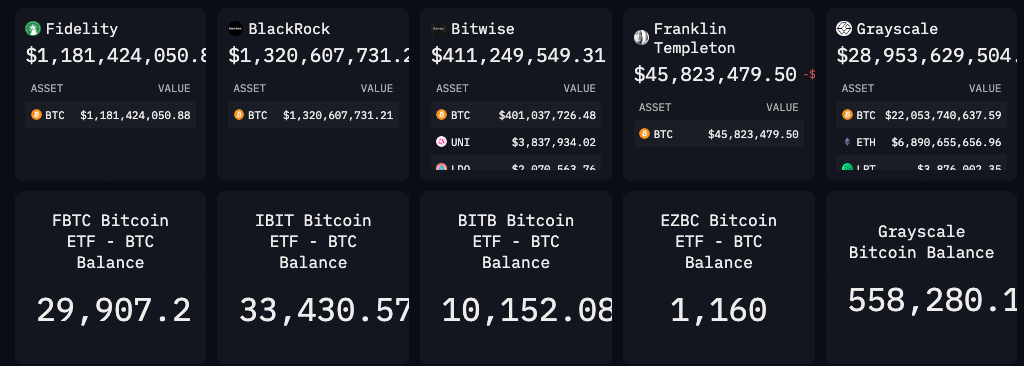

According to reports, Arkham Intelligence, a blockchain research platform, has successfully pinpointed the on-chain Bitcoin addresses associated with various spot BTC exchange-traded funds (ETFs) in the United States.

As per the available data, BlackRock’s iShares Bitcoin Trust (IBIT) presently possesses 33,430 BTC, equivalent to approximately $1.3 billion. This information aligns with publicly disclosed data on IBIT holdings available on BlackRock’s official website. Meanwhile, the largest among the approved funds, Grayscale’s Bitcoin Trust (GBTC), holds a substantial 558,280 BTC, valued at nearly $29 billion as of the current moment.

While the transparency resulting from the disclosure of on-chain addresses for spot Bitcoin ETFs has its advantages, some executives have cautioned against potential security risks associated with this practice.

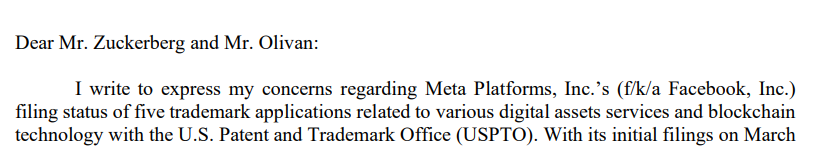

U.S. Lawmakers Question Meta on Crypto and Blockchain Plans

The U.S. House Financial Services Committee is urging Meta to disclose any plans it may have related to blockchain or crypto. This call comes as five cryptocurrency and blockchain-related trademark applications, dating back to 2022, are still active.

In a letter dated January 22, Committee ranking member Maxine Waters addressed Meta founder and CEO Mark Zuckerberg and operating chief Javier Olivan. Waters stated that the trademark applications, all submitted on March 18, 2022, “seem to indicate an ongoing intention to broaden the company’s participation in the digital assets ecosystem.”

Waters highlighted that despite Meta informing Democratic Financial Services Committee staff on October 12, 2023, that “there is no ongoing digital assets work at Meta,” the trademark applications suggest otherwise, indicating ongoing efforts related to digital assets.

The trademark filings encompass a range of services related to crypto and “blockchain assets,” including trading, exchange, payments, transfers, wallets, and the associated hardware and software infrastructure.